Tax Planning Solihull

Tax planning can be overwhelming and confusing. We aim to explain the process in a simple, jargon-free way

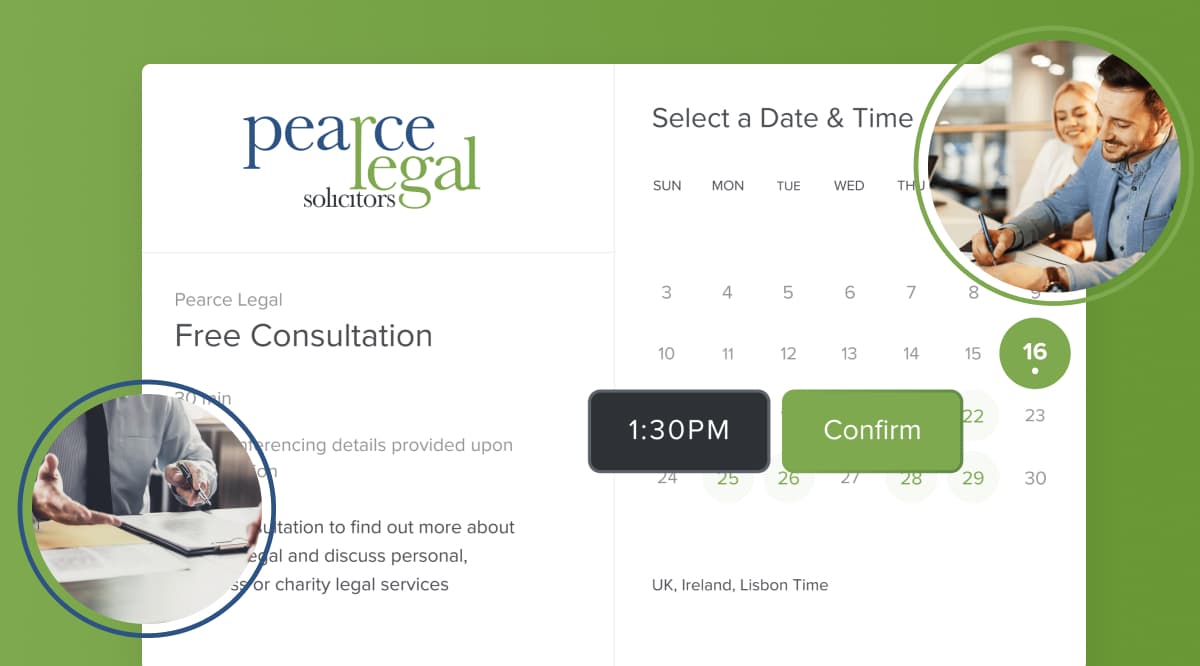

Book your free consultation

Are your tax affairs in order? Have you considered the effect of taxation on your children in the future? Are you saving in the most efficient way for your future costs or your retirement?

Tax and Lifetime planning has never been as important as it is now. Pearcelegal brings you a wealth of knowledge and understanding to help you make the very best of your money. We cover inheritance tax planning, capital gains tax, income tax, future financial planning for your children and more.

We can also look at reducing tax exposure for our clients and their children. Lifetime planning goes beyond setting up a Will and dealing with inheritance and other tax planning. Other areas include: preparing and administering lasting powers of attorney (should you become unable to make your own decisions), setting up and administering trusts and dealing with residential care fees.

Lifetime planning can also include providing for children or other dependents with disabilities. This area always needs very careful thought, for example, how should appropriate arrangements for their future care be set up? Our friendly and caring approach, coupled with wide-ranging knowledge and experience, is available to give you peace of mind over all of these potentially complex arrangements.

Frequently asked questions

Do I need a solicitor to help me with tax planning?

We recommend working with a solicitor to navigate the rules and regulations. An experienced solicitor can help you to identify opportunities and threats to your income and assets. Tax planning can also be combined with your Will to ensure you do not pass on an excessive tax burden with your inheritance.

Can anyone benefit from tax planning?

If you plan to leave money or assets in your Will, tax planning can help to lessen the tax burden on your beneficiaries.

Is tax planning legal?

Yes, tax planning is a completely legal practice. It is not the same as tax evasion. Tax planning involves working within tax regulations to maximise your position. If you are planning to use tax planning to conceal income, this would be considered illegal.

What is the importance of tax planning?

Tax planning allows you to make the most of your tax-free allowances and helps to avoid burdening your family with a tax headache when they inherit your estate. It’s also helpful to ensure that you remain compliant with local tax regulations.

Our specialists in Tax Planning

Graham Pearce

Director

Rachel Ison

Associate Solicitor and Head of Department for Private Client

Madeline Hill

CILEx Paralegal

For individuals

- Family Law

- Divorce

- Child Law

- Civil Partnerships

- Cohabitation Rights & Agreements

- Pre and Postnuptial Agreements

- Wills, Trusts & Probate

- Making or Amending a Will

- Contesting a Will

- Trusts

- Tax Planning

- Lasting Power of Attorney

- Court of Protection

- Probate

- Employment Law

- Conveyancing Solihull

- Dispute Resolution

- Personal Injury

Get expert advice at a time that works for you

Book your free 30 minute consultation at a time and date that works for you.

Book your free consultation