How Will the 2022 Stamp Duty Changes Affect Me?

Stamp Duty| 06.05.2022

Unless you have been in the wilderness for the past couple of weeks, you will certainly be aware of the Chancellor of the Exchequer, Kwasi Kwarteng’s mini-budget announcement that, among other proposals, the stamp duty thresholds have changed.

The aim of lowering the rates of SDLT is to help stimulate growth within the UK economy and bolster the housing market. What you may not be aware of is that these have already been implemented, meaning that as of 23rd September 2022, those buying residential property will pay less or no stamp duty. In this article, we will explain the 2022 changes to stamp duty land tax (SDLT) and how you may be affected.

How Have The Stamp Duty Thresholds Changed From 23rd September 2022?

Exactly how the new SDLT thresholds apply to you will depend on whether:

- you are a first-time buyer

- you pay standard rate stamp duty (the standard rates of SDLT apply if you are buying your main residential home, and this is your only property, but you are not a first-time buyer), or

- you pay the higher rate of stamp duty (the higher rates of SDLT apply if you are purchasing a second or subsequent property).

The New First-time Buyer SDLT Rates

First-time buyers of their main residence stand to gain significantly from the new budget announcement. As announced in the mini budget, for those buying their first home, First Time Buyers’ Relief was increased from £300,000 to £425,000. This means that no stamp duty is payable up to £425,000. In addition, the cap on how much a purchaser can pay for a property to qualify for First Time Buyers’ Relief has risen to £625,000 from a maximum of £500,000.

The new rules are expected to reduce the amount of SDLT for first-time buyers; for example, a first-time buyer under the old SDLT rates paying £400,000 for their home would have paid £5,000 in stamp duty. Under the new SDLT rules, the same first-time buyer will pay no stamp duty.

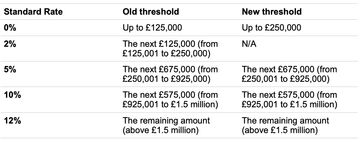

The old and new standard SDLT rates above

The new standard rate SDLT rules mean that buyers no longer need to pay the 2% rate and that no stamp duty is payable on the first £250,000 of a property’s value.

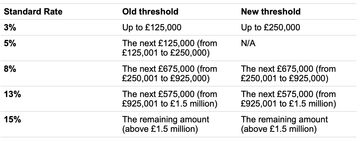

The old and new standard SDLT rates above

Under the new higher rate SDLT thresholds, the 5% rate has been removed, meaning that a person buying a second or subsequent property will only pay 3% in stamp duty on the first £250,000 of a property’s value.

How Have Overseas Buyers Been Affected By The New SDLT Rates?

In 2021, the government introduced a new 2% overseas surcharge for non-UK residents purchasing property in England and Northern Ireland. Unfortunately, the new stamp duty rates for 2022 have not changed for overseas buyers.

Will I Benefit From The Lower SDLT Rates If My Property Purchase Was Underway Before 23rd October 2022?

Yes, the stamp duty you owe is calculated on the date of completion. As such, if you were expecting to pay SDLT using the old rates, but you have not yet completed the purchase of your property, you will benefit from the new lower thresholds.

Final Words

While it remains to be seen whether the lowering of stamp duty will offset the negative effect of rising mortgage interest rates we are currently experiencing, many buyers will welcome the news. Much will depend on your buying circumstances, where you intend to purchase, the purchase price, and how much you need to borrow. We can only hope that the government will make further moves soon to make home ownership a realistic aim for everyone in the UK.

The residential property conveyancing team at Pearcelegal has the experience and legal expertise to advise and represent you with any property sale, purchase, or other legal matter. To make an appointment, please contact us on 0121 270 2700 or enquire through our contact form.

Expert advice for you Book a free consultation

The team at Pearcelegal will be delighted to discuss your legal matters and give you a no-obligation quote.