Wills, Trusts & Probate

Book your free consultation

We understand that discussing details of your personal affairs as well as those of loved ones who have passed away is difficult and often stressful. We have over 40 years' experience of advising on private client matters including Lasting Powers of Attorney, Tax planning, Probate and administration of estates.

Our specialist team will advise on any aspect of Probate, from obtaining a Grant to administering the full estate and we pride ourselves on our caring and friendly approach.

We can help you to set up Wills, Lasting Powers of Attorney and Trusts as well as provide tax planning advice. If you are assisting a loved one who has lost mental capacity we can also advise on making an application to the Court of Protection.

For more information on finding out if you need a will or the services we can offer, please click on one of the links below.

Our specialists in Wills, Trusts & Probate

Graham Pearce

Director

Rachel Ison

Associate Solicitor and Head of Department for Private Client

Madeline Hill

CILEx Paralegal

Laura Ralph

Trainee Solicitor

For individuals

- Family Law

- Divorce

- Child Law

- Civil Partnerships

- Cohabitation Rights & Agreements

- Pre and Postnuptial Agreements

- Wills, Trusts & Probate

- Making or Amending a Will

- Contesting a Will

- Trusts

- Tax Planning

- Lasting Power of Attorney

- Court of Protection

- Probate

- Employment Law

- Conveyancing Solihull

- Dispute Resolution

- Personal Injury

“All staff were very welcoming and always available to talk to. We felt we were in safe hands while dealing with a stressful situation.”

Mr & Mrs Rowbottom

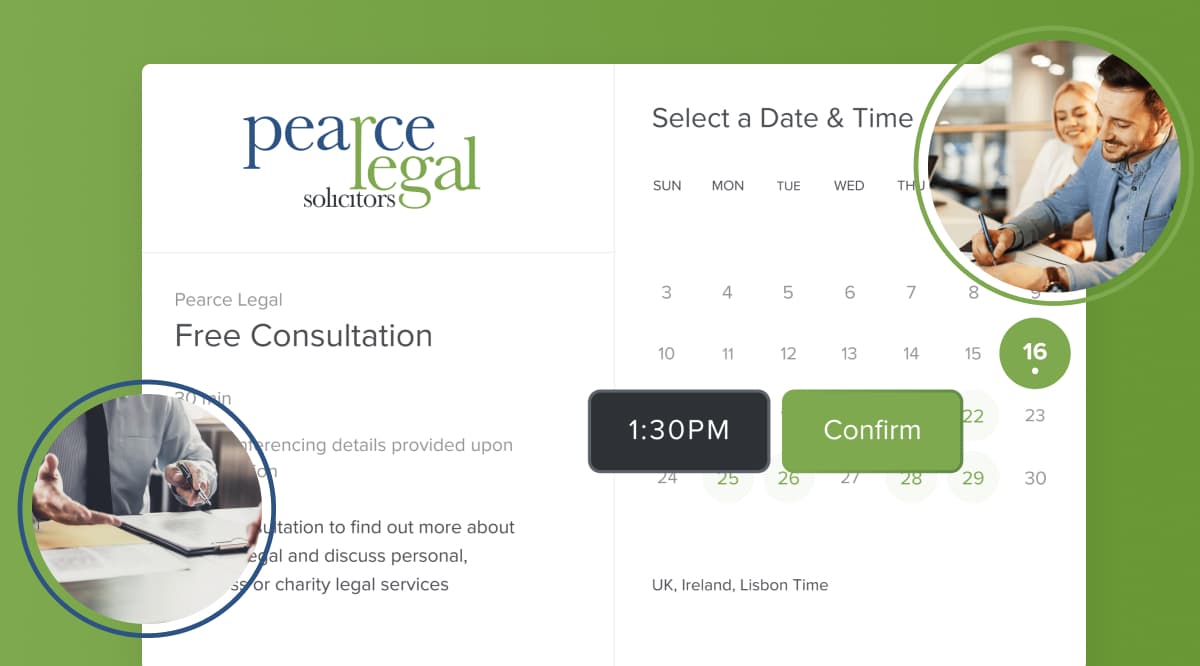

Get expert advice at a time that works for you

Book your free 30 minute consultation at a time and date that works for you.

Book your free consultation