Financial Agreements in Solihull

A financial agreement is used to untangle your finances and determine how your shared assets will be divided following a separation or divorce.

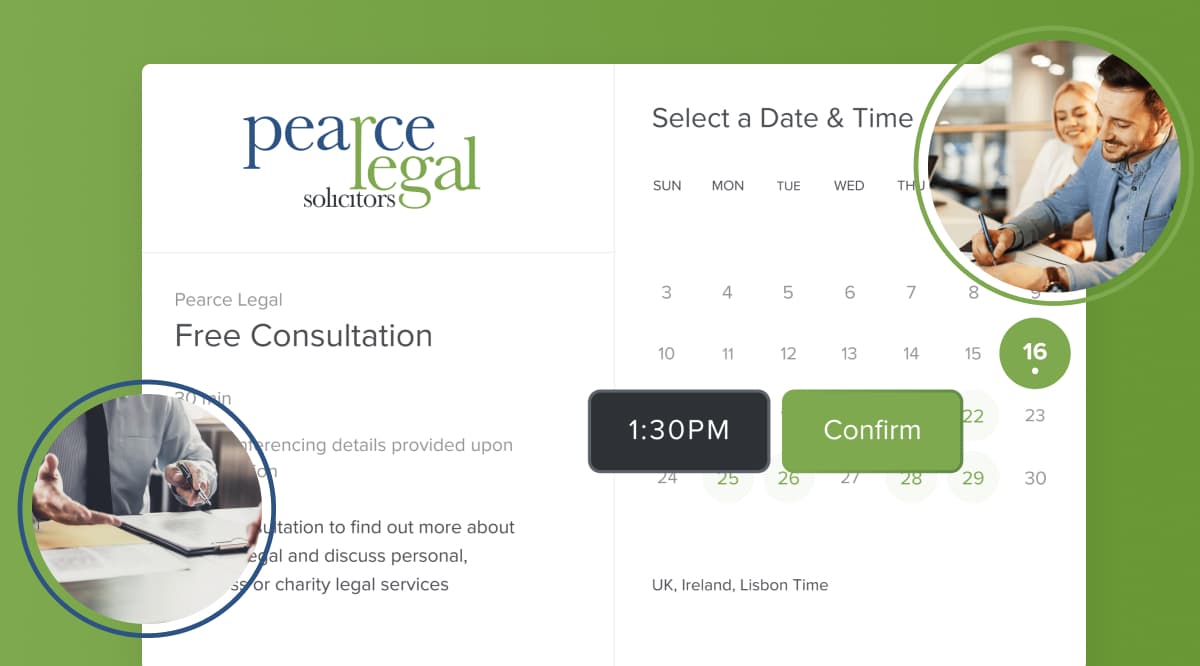

Book your free consultation

Our team of family solicitors can help you to navigate the complex process of untangling your finances. Income, pension, assets, property and debts will need to be divided so you can both move forward with your lives.

Obtaining a financial agreement will sever the financial relationship between spouses. Without a financial agreement, a spouse may be able to make a claim to their ex-partner's assets, even long after a divorce is granted. This is why it is important to reach a financial agreement so that both parties will know what is expected of them and what they can expect from their ex-spouse. Our skilled and experienced team can guide you through the process of untangling your assets to ensure you reach a fair agreement.

Financial agreements explained

Reaching a financial agreement can allow you to move on with your life. This important part of the separation and divorce proceedings will untangle your finances and determine who is entitled to what. Your financial agreement will cover the following:

Assets including property, savings and investment

Pensions

Regular maintenance

Debts

Couples can obtain a divorce without a financial agreement, but it is helpful to have one in place. The financial agreement will sever the financial relationship with your spouse. It is vital for the success of the agreement that both parties are open and transparent about their financial situation.

Financial agreements before marriage

You can put arrangements in place before and during marriage to determine what will happen to your assets in the event your relationship breaks down irrevocably. This is called a prenuptial or postnuptial agreement.

Disputed financial agreements

In a situation where an agreement cannot be reached, we can work with you through mediation. Working with a mediator is often the final step before applying to the courts for a financial settlement.

Frequently asked questions

What is a financial agreement in divorce?

How is money divided in a divorce?

Who is responsible for the shared debt after a divorce?

How do I protect myself financially in a divorce?

Our specialists in Financial Agreements

Nicholas Thomas

Managing Director

Stephanie Howard

Associate Solicitor

Hannah Smith

Assistant Solicitor

For individuals

- Family Law

- Divorce

- Child Law

- Civil Partnerships

- Cohabitation Rights & Agreements

- Pre and Postnuptial Agreements

- Wills, Trusts & Probate

- Making or Amending a Will

- Contesting a Will

- Trusts

- Tax Planning

- Lasting Power of Attorney

- Court of Protection

- Probate

- Employment Law

- Conveyancing Solihull

- Dispute Resolution

- Personal Injury

Get expert advice at a time that works for you

Book your free 30 minute consultation at a time and date that works for you.

Book your free consultation